Warning: Undefined global variable $buildercount in /home4/sqzstage/public_html/rush/wp-content/themes/rush/functions.php on line 155

Protecting your wealth – the 2022 view

It’s hard to know where to turn, with equities in free fall, rollercoaster rides in crypto markets, savings rates still low, and our cash less valuable than it was with inflation rising.

Many are asking whether there is a better form of money that will protect the value it represents.

First of all, what is the role of money? Money is a store of value, a means of exchange and a unit of account – and its primary job is to keep pace with the costs of goods and services.

So how is this going?

![]() As a store of value – In Australia, wages have failed to keep pace with inflation over the past 12 months. That means the “real” value of wages – what can be purchased day by day or week by week – has been deteriorating.

As a store of value – In Australia, wages have failed to keep pace with inflation over the past 12 months. That means the “real” value of wages – what can be purchased day by day or week by week – has been deteriorating.

- Means of exchange

- As a unit of account

And its primary job – to keep pace with the cost of goods and services? Not right now in an inflationary environment…

Is crypto the answer?

While crypto can also meet a few of these criteria, it’s also currently extremely volatile. Sensational newspaper reports are framing a so-called financial “bloodbath” as some panicked crypto currency investors say they will lose their homes because the value of crypto currencies (including Bitcoin) has plunged.

Gold as money

So if you agree with this definition of money, then maybe it’s time to consider gold?

- As a store of value – Gold is anchored in exactly the activities that money is meant to facilitate, by governments, corporations and individuals. For example:

• a high-tech manufacturer may buy gold for use in electronic manufacturing

• a central banker in Turkey may use gold to defend the relative strength of the nation’s currency

• an Indian consumer may buy a gold necklace as a form of savings

• a Vietnamese family may buy gold to buy a house (in Vietnam, a large proportion of house purchases are settled in gold)

- Means of exchange – it has appreciated against the major currencies this millennium. On an annual basis it has risen an average of 9.2 per cent against the major currencies.

And with Rush, you can use your gold just like you would use a bank currency like the Australian dollar or the British pound.

- As a unit of account – Gold is the original unit of account and has endured for more than 2,000 years of human history. Significantly, it requires no state, no governing body, no council of elders to try to determine the correct price or quantity of money needed at any point in time in the society.

And its physical properties are also important – it doesn’t oxidise or rust away. In fact, practically all the gold ever mined in history is still in circulation above ground.

And gold is very rare. According to the US Geological Service, two thirds of the world’s recoverable gold has already been mined, with just a third remaining below ground.

And in terms of keeping pace with the cost of goods and services?

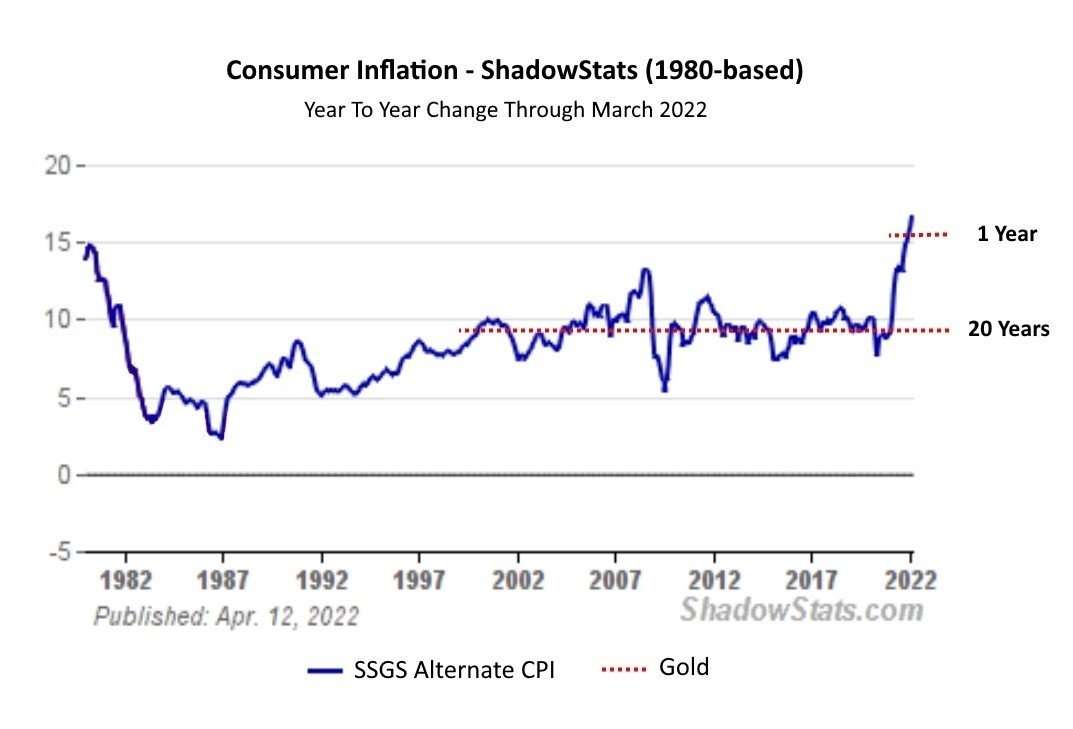

We can see how well gold has tracked against the real-world costs of goods and services in the following chart (inflation measured using 1980 calculation methods by Shadowstat):

Additionally, the one-year gold returns (14.9 per cent in USD through March 2022) are keeping pace with the jump in inflation 2021-2022.)

As a form of money, gold has endured every revolution and every change of government. It has survived multiple wars that spanned the globe and devastated the world economy. It has endured the fall of Rome, the Black Plague, and the Dark Ages. Moreover, it has kept pace with the Industrial Revolution and even with the technological revolutions of the 20th and 21st centuries.

So what does that mean for investment strategies?

Gold has always been the go-to for wealthy investors to protect their portfolios in times of instability.

With many investment options being affected by the pandemic, war in Ukraine, supply chain issues and inflation, many investors are adding more gold to their portfolio as a reliable store of wealth.

Time for you to buy gold?

Rush Gold is an award-winning, innovative digital way to invest in gold. With no minimum investment, Rush Gold democratises the access to gold investment. Buy, sell, send or gift gold – all at your fingertips, 24 hours a day.

Download the app now to purchase gold that moves with you.