From $20 in 1920 to $2000 in 2020, four main factors drive gold prices

This year, given the global macro-economic and political situation, we are paying particular attention to the writings of Credit Suisse star analyst Zoltan Poszar.

If Poszar is right, we are likely on the verge of another secular gold price move.

In his 6 January 2023 article entitled simply “War and Peace”, Pozar begins his analysis by reminding us that investors today are not particularly well trained to deal with geopolitical risk. He states that this is because for generations, geopolitics didn’t matter:

“Anyone who traded securities or ran a portfolio since the end of World War II did so in the cocoon of a unipolar world order, under the cover of Pax Americana [American Peace]”.

Poszar notes that unipolar domination by the U.S. post-World War II is coming to an end, and a new multipolar world, with competing centres of trade, finance, and military power including China, India, and Russia, is emerging.

He says that given the Russian war against NATO in Ukraine, investors should abandon the idea that the post -WWII world order will remain stable.

Poszar goes on to list the consequences of war, including that war is good for industry, war is inflationary, and war encumbers commodities.

But Poszar also proposes an additional consequence: that war destabilises the price of money. Or, rather, it destabilises the prices of money.

The Four Prices of Money

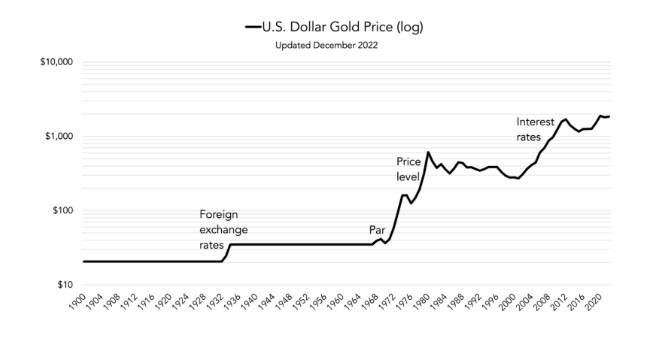

Pozsar’s money framework, which he developed from the work of his intellectual mentor Perry Mehrling, states that money has four prices: Foreign Exchange, Par, Price Level, and Interest Rates:

- Foreign exchange rates, which is the price of foreign money. For example, the ratio between the dollar and the euro, or between the dollar and gold (since gold sometimes backs and behaves like a currency).

- Par, which is the price of different types of the same money. Cash, bank deposits, and money fund shares should always trade at a one-to-one ratio.

- Price level, which is the price of commodities and, via commodities, the price of all goods and services. This is usually referred to as inflation.

- Interest rates, which is the price of future money.

Poszar states that instability in any one of these prices of money tends to move gold higher. He cites the following examples:

- Foreign exchange rates: The gold-backed U.S. Dollar was repegged overnight from $20 to $35 per ounce in 1933. America devalued the dollar against gold to compete with foreign nations by cheapening the dollar against foreign currencies.

- Par: In the 1960s the US started printing too many dollars relative to the amount of gold it owned backing those dollars. The U.S. Treasury had to sell thousands of tonnes of gold as a result. To stop the bleeding, it was decided to let the gold price float in the free market in 1968, and it climbed from $35 in 1967 to $43 in 1969.

- Price level: An abundance of dollars created in the 1970s led to double-digit consumer price inflation. The gold price rose from $45 to a peak of $800 dollars in 1980.

- Interest rates: The Dot-com bubble popped in 2000 and the Fed slashed rates from 6% to 1%. The gold price started rising again and touched $1,900 dollars per troy ounce in 2011.

The log scale chart below shows each of these changes to the prices of money and how they affected gold:

Source: U.S. Federal Reserve

When Do the Prices of Money (And of Gold) Usually Change?

Like a sleuth at the scene of a crime, Poszar homes in on what usually prompts the prices of money to change: bear markets.

This insight could be very useful to us today as the 2022 bear market continues into 2023.

Prominent gold analyst Jan Nieuwenhuijs from The Gold Observer agrees:

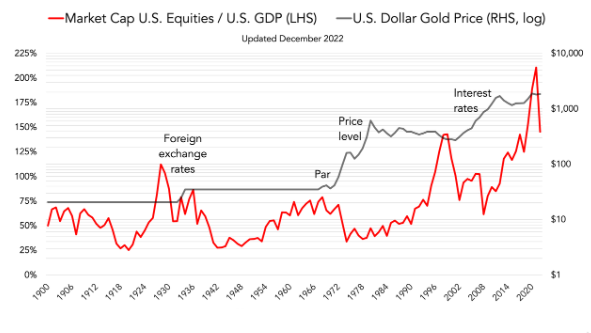

“Changes in the price of money often come after an economic downturn that a central bank counters by, for example, lowering interest rates. Easy money blows a new equity bubble. Once that pops, easier money still blows another bubble to replace the previous one. This leads to a vicious cycle of bubbles and ever-easier money, in which the value of money incrementally declines, and the gold price appreciates”.

This “bubble – pop – new bubble – new pop” effect on the gold price can be seen in the chart below. The red line shows the stock market level, relative to the economy that underlies it (GDP), and the black line overlay from the chart above shows that the major repricings of gold take place following stock market declines:

Source: U.S. Federal Reserve, Wilshire Associates

Each of the major equity declines (1929 crash, Nifty Fifty crash of the 60s, the Dotcom crash) was followed thereafter by an upward repricing of gold.

But, as we can see at the end of the chart, the repricing of gold driven by the current stock market downturn has just begun.

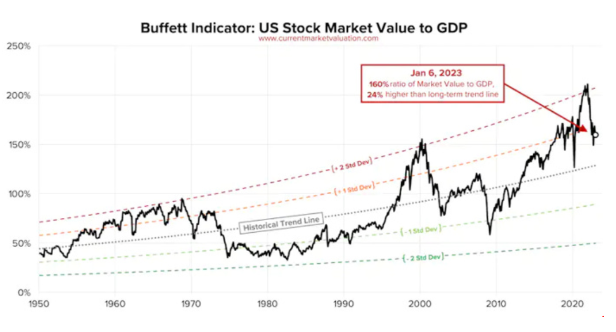

And the favourite metric used by the famous investor Warren Buffet (known simply as The Buffet Indicator) amplifies this analysis:

Source: Wilshire Associates

In the above chart, even after the current market declines, stock market levels are still just even with the Dot-com peak. This could mean that further equity declines, and thus further impetus for gold price rises, may still be ahead, if and as share prices revert to historical trend levels.

The Next Repricing of Gold May Have Already Begun

In 2022 gold prices were stable or rose (depending on where you live) even in the face of two of gold’s biggest traditional headwinds, a rising U.S. dollar and rising interest rates.

While gold was flat for the year in U.S. dollars, in Australian dollars it rose 6%, in Euros it rose 8%, and in Japanese yen it rose 14%.

This strength in gold prices despite these headwinds has been noted by analysts from Credit Suisse to Goldman Sachs, both of whom have raised their gold price targets for 2023. Goldman’s new target is USD $2500, and the new Credit Suisse target is USD $3000.

Credit Suisse’s Poszar helps us understand the background mechanisms that tend to propel gold higher. It looks to us like more than one of them will be in play as the year (and the war) marches on.

And when technical, fundamental, and sentiment indicators all align positively (as they are today) against the backdrop of these kinds of generational, secular tailwinds, then the bull market case for bullion gets easier and easier to make.