Monetary and industrial silver drivers have come together at the same time like never before. This makes for amazing opportunities to profit from silver, which tends to enjoy multi-year bull markets.

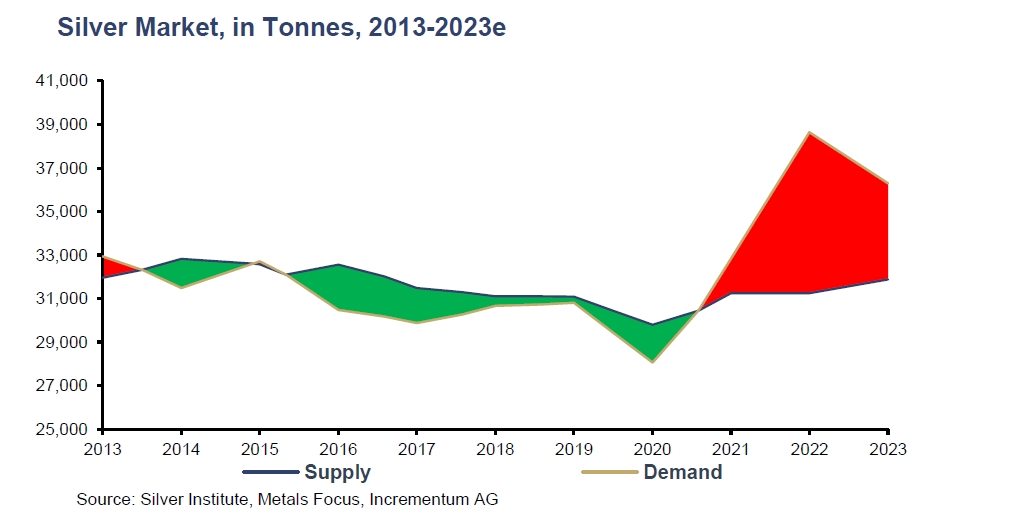

A combination of dwindling silver supply and resilient industrial demand is providing fertile ground for potential further silver price increases.

- The green energy transition is driving innovation in the solar PV industry, where increased silver loading in solar panel technologies is further strengthening silver industrial demand, along with continued EV adoption.

- Government policies such as the Inflation Reduction Act in the U.S. are set to have an insulating effect on silver industrial demand, as commitments to Net Zero ramp up.

- Nonindustrial silver demand has also remained strong in 2023, propped up by substantial jewelry and silverware demand from India, thus exacerbating an already broadening silver supply deficit.

- Silver is the second most used commodity in the world, after oil. It is critical to more than 1,000 different industrial processes, from water purification through to high-tech armaments.

- Where the yellow metal goes, its little brother silver tends to follow in a more dramatic fashion.

The silver supply deficit situation can be seen in the chart below:

Analysts expect the prolonged absence of major capital expenditure in the silver mining business to be reflected in a future for the shiny metal that is characterized by unprecedented scarcity.

As precious metals analytical firm Incrementum wrote last year:

“If past cycles are anything to go by, silver will be pulled along by gold throughout the 2020s as we experience geopolitical and socioeconomic upheaval…. Then silver will take over and be pushed forward by the hot winds of inflation for a decade or two as governments need to burn off the current private and public debt levels.

So we are bullish on silver through to the 2040s, but after that you’re on your own.”