Why Gold in 2019 according to The World Gold Council

“As we look ahead, we expect that the interplay between market risk and economic growth in 2019 will drive gold demand. And we explore three key trends that we expect will influence its price performance: financial market instability, monetary policy and the US dollar, and structural economic reforms. Against this backdrop, we believe that gold has an increasingly relevant role to play in investors’ portfolios.”

Why Gold is Valuable

According to The World Gold Council there are four attributes that make gold a valuable strategic asset:

- it provides a source of return

- it has a low correlation to major asset classes in both expansionary and recessionary periods

- it is a mainstream asset that is as liquid as other financial securities

- it has a history of improved portfolio risk-adjusted returns.

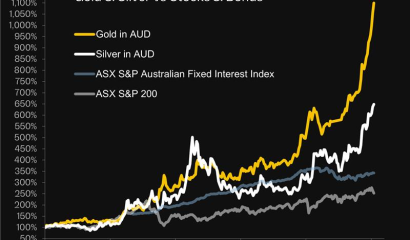

In 2018 these factors all came into play in gold’s price performance relative to other assets. As the chart below shows, gold outperformed shares, commodities, and balanced funds for the year:

(Note: the “Long USD Gold” line on the chart is an index of gold performance in currencies other than the U. S. Dollar, including the Euro, the Japanese Yen, and the British Pound).

Why Gold now in 2019

In 2019 the Council expects a carry-over of the three main factors that drove gold performance in 2018:

- financial market instability

- monetary policy and the U.S. Dollar

- structural economic reforms

The first factor drives gold performance as investors seek safe havens from market volatility, which has continued so far this year.

The second factor affects gold’s headline USD price, but the U.S. Federal Reserve is expressing a more neutral stance from the policies that drove relative dollar strength last year.

And the third factor, economic reform that will continue to support demand for gold in jewellery, technology and as means of savings, looks to continue especially in the countries across Asia that are responsible for 70% of global gold demand.

So Happy New Year to all our customers, and we hope you will make it a golden one!

Read full report from the World Gold Council.

Read more about gold liquidity.