Warning: Undefined global variable $buildercount in /home4/sqzstage/public_html/rush/wp-content/themes/rush/functions.php on line 155

Yesterday Goldman Sachs released a research report to their largest clients, saying the case for owning gold is now “as strong as ever”.

https://finance.yahoo.com/news/goldman-says-case-diversifying-gold-202759315.html

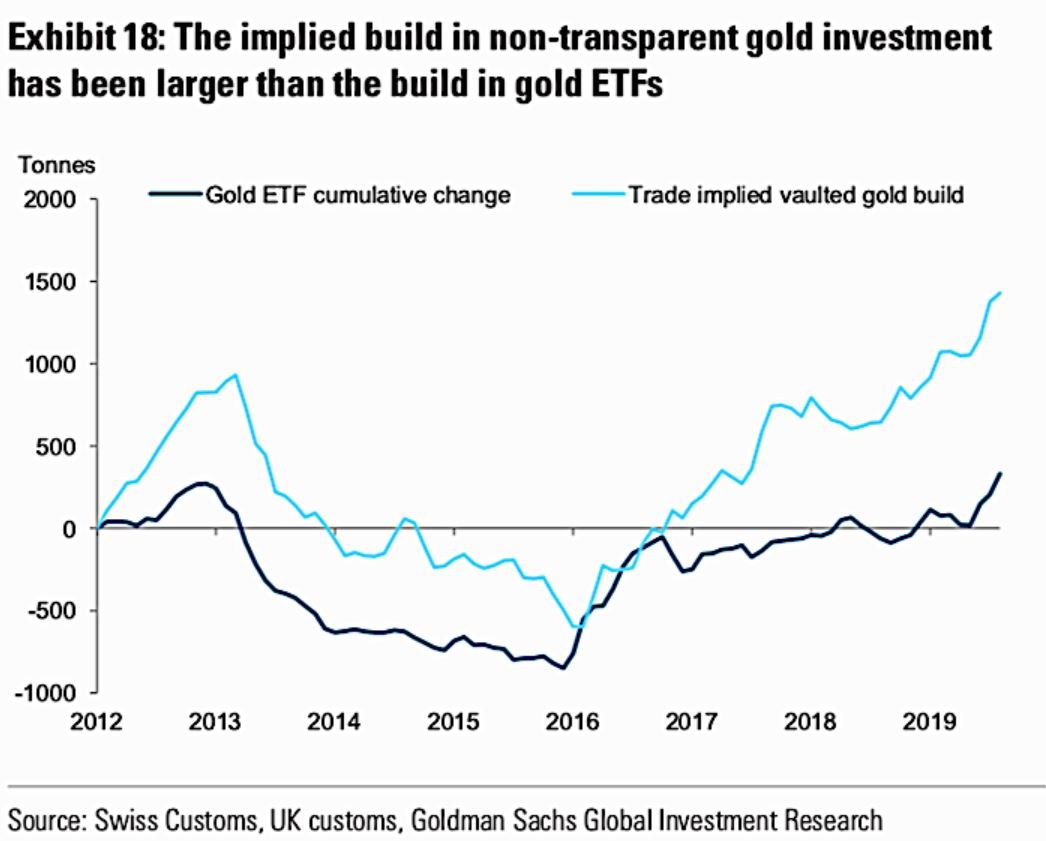

But towards the back of the Goldman report was an interesting chart.

We’re always on the lookout for new data points that help our customers understand what’s happening in the gold market.

Many analysts follow the inflows of physical gold into ETF products. They use this data to gauge institutional gold demand. ETF flows are shown as the black line on the following chart:

But what caught our eye, explained in the report, is the blue line on the chart.

Goldman analysts did the legwork of asking the major vaulting services (like Brink’s Global Services and G4S) and national customs regulators how much gold in total was actually flowing into their countries and vaults.

This is interesting because it captures gold demand by large investors that would otherwise not be reported elsewhere.

The conclusion is that large investors are adding significantly more to their gold holdings than has otherwise been reported.

With currency and trade wars around the globe and the shift in policy by the Reserve Bank of Australia to so-called “quantitative easing”, we agree with Goldman Sachs: the case for owning gold is getting stronger than ever.

Own a part of SendGold today. Minimum Investment $250. We are now open to crowdfunding and our current phase ends on Thursday, the 19th of December. Don’t miss out!

SendGold has been shortlisted for the My Business Awards 2019