Warning: Undefined global variable $buildercount in /home4/sqzstage/public_html/rush/wp-content/themes/rush/functions.php on line 155

In this two-part post, we will look at 3 things:

- How gold performed in the 2008 GFC

- Why the Covid-19 financial crisis is different

- How financial assets, including gold, might be expected to perform as the current crisis plays out.

We discuss the first two points in this post (Part 1).

Gold in the 2008 Crisis

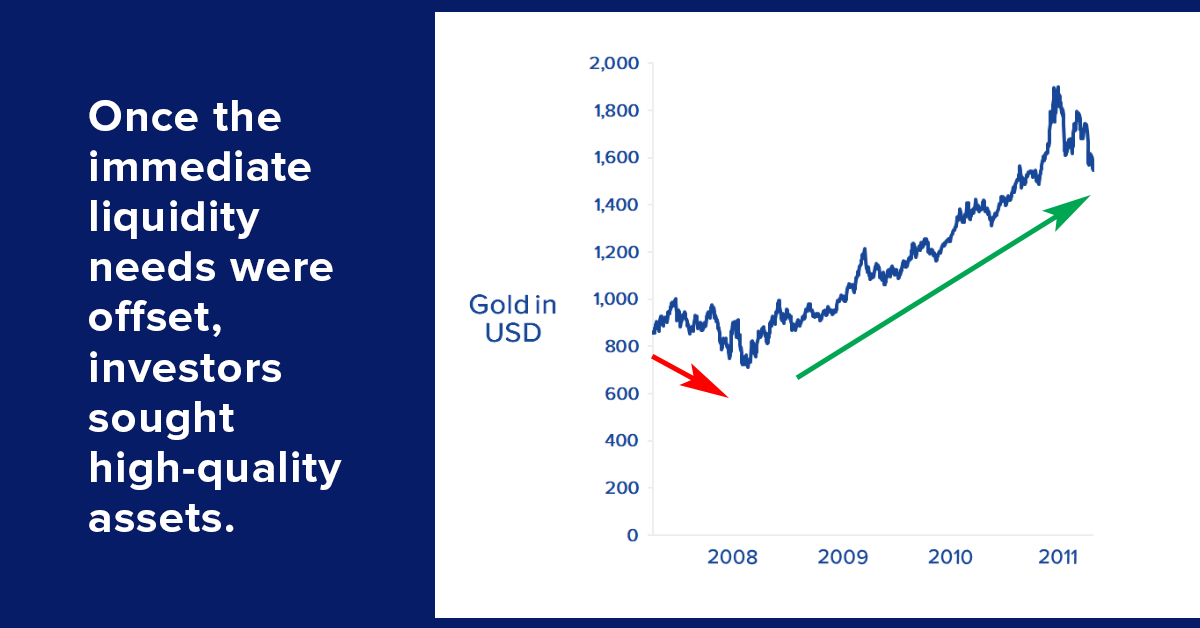

The chart above shows the price of gold during and after the 2008 GFC. Of note is the initial reaction in 2008: gold declined. This was because gold is an extremely liquid asset with broad global participation and very deep markets. Investors liquidated gold in order to shore up losses elsewhere on their balance sheets and to avoid margin calls.

Once the immediate liquidity needs were offset, investors sought high-quality assets to invest in. Title to Physical Gold fit the bill because it is the safest investment asset there is: its value does not depend in any way on the performance of a counterparty. With doubts still lingering about the solvency and performance of counterparties of all kinds, including banks, funds, corporations, and even sovereign governments, investors sought out history’s best safe haven.

If we compare gold performance after the 2008 pre-crisis low to today’s gold bull run (so far) then we might expect that the current run still has a good ways to go:

But the Covid-19 financial crisis is different

The 2008 crisis started as a demand crisis as the solvency of global banks came into question. This made for an expensive but relatively straightforward fix, since the U.S. Federal Reserve Bank (and the other central banks) could inject money directly into banks.

But the Covid-19 crisis is manifesting first as a supply side crisis, as supply chains and companies shut down. So it is both the banks and their customers who require a bailout. And that supply shock is now spilling over to be a demand shock too.

And while the U.S. Federal Reserve is moving swiftly to support the financial assets of companies (through new overnight money market support and direct corporate bond purchases) they cannot support companies (and their employees) directly. That job is left to governments, who are now preparing very large fiscal stimulus and even direct payment packages.

In Part 2 we will comment on how financial assets including gold might be expected to perform as the current crisis plays out.

Keep Calm and Carry On (Buying Gold) amid Covid-19

Jodi Stanton recognised as a finalist at the Women Leading Tech Awards

Keeping our Clients Informed About Gold

Download our new app now and BUY 100% title to GOLD in minutes