Warning: Undefined global variable $buildercount in /home4/sqzstage/public_html/rush/wp-content/themes/rush/functions.php on line 155

The U.S. election promises a level of uncertainty not seen since the year 2000 debacle, when the outcome was only decided in the courts after 40 days of legal wrangling. Gold investors have an opportunity to position today to take advantage of a similar situation.

Generally, the more politically uncertain the climate, the more of a safe-haven asset gold becomes and gold prices tend to rise.

Global investment bank UBS made this point in a recent research note to their clients:

“A contested U.S. presidential election outcome is a strong possibility, and it could add to further volatility and result in safe-haven flows, though more into gold, the Swiss franc, and the Japanese yen than into the US dollar, in our view. The greenback’s longer-term trend is also downward due to its weaker interest rate advantage and the extent of US indebtedness. Since gold is priced in US dollars, a weaker dollar favours it [gold].”

After correcting lower towards the end of September on profit-taking after its steady climb over the last 18 months, gold prices have been stabilising in October. This gives investors a chance to accumulate gold at favourable prices before any election (and market) uncertainty begins two weeks from today.

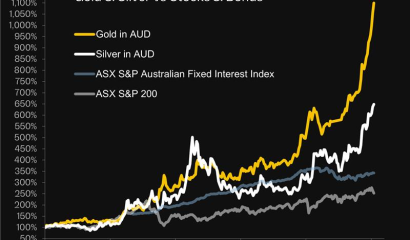

Given that the yellow metal is likely to remain predominantly driven by the interest rate environment, this will continue putting a floor below hard assets such as gold with the Fed’s new average inflation targeting framework likely to help keep the USD rate advantage firmly capped.

Most importantly, such conditions should also keep gold’s sensitivity low to periods characterised by improving risk appetite after the election is finally decided. This makes sense when considering that gold may become more attractive as an inflation hedge.

Overall, we believe risk/reward should continue to favour buying dips in gold, especially as the U.S. nears what looks to be a historically uncertain election.

SendGold and Jodi Stanton recognised at the Finder Innovation Awards

SendGold presents industry best practices for compliance

SendGold recognised as a finalist at Fintech Australia’s Finnies 2020