The main drivers of gold prices we outlined in our 2020 Gold Outlook, namely money printing, currency wars, and market and political instability, are still firmly in place as we move in to 2021. At its core we believe the investment thesis to accumulate gold under these prevailing market and economic conditions remains very solid.

Since the start of the GFC investors have seen the number of dollars (AUD) required to obtain an ounce of gold move ever higher. 800, then 1200, then 1400, then 1800, then 2000. In 2020 we saw that number briefly overshoot to 2800, to then settle back at current levels of 2400. At Rush, we love a trend you can see on a chart from across the room, and this one certainly qualifies.

2020 was amazing for gold

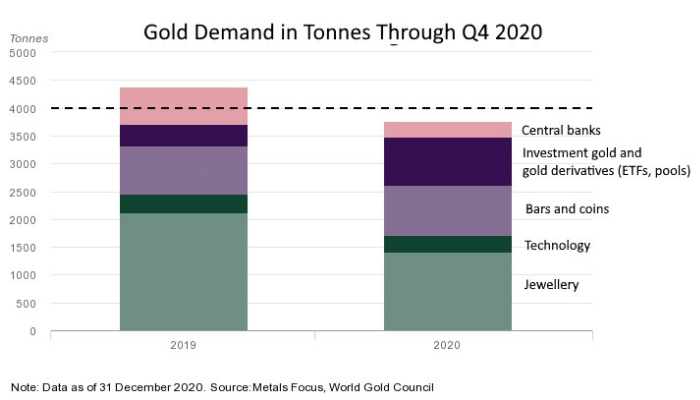

That gold rose 13% (in AUD terms) and 25% (in USD terms) in 2020 is great. But what is amazing to us is that it did so even in the face of a 13% decline in demand:

Central bank demand declined in 2020, mainly because Russia has met their gold accumulation target (their reserve holdings of gold, at roughly 40%, have now surpassed their holdings of USD).

Jewellery demand also dropped sharply, as gold jewellery sales declined. Jewellery owners cashed in their gold to help make ends meet during the lockdowns.

However, demand for investment gold and gold derivatives like ETFs increased, as did bars and coins held for investment purposes. Gold sometimes trades like an investment, sometimes like a hedge, and sometimes like a commodity, and the investment rationale won the day in 2020.

Was gold the ideal asset to own in 2020?

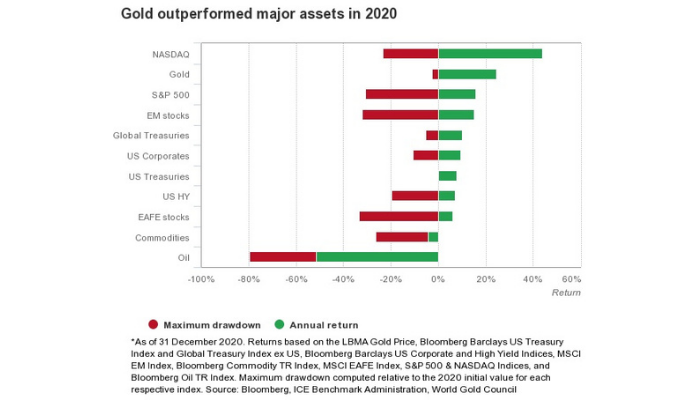

Equally amazing is how gold behaved as the nearly perfect investment asset in 2020, outperforming all but the frothy NASDAQ index while showing almost no drawdowns along the way:

Investors will have noted that their gold outshined on the reward side while protecting them on the risk (volatility) side better than nearly every other major asset class.

Will gold be the ideal asset to own again in 2021?

Scenario 1 is that the vaccines succeed in getting economies open and corporate earnings growing again. This “recovery” scenario would likely see a rebound in jewellery demand and continued strong gold demand by investors as markets reach new highs, leading to higher gold prices.

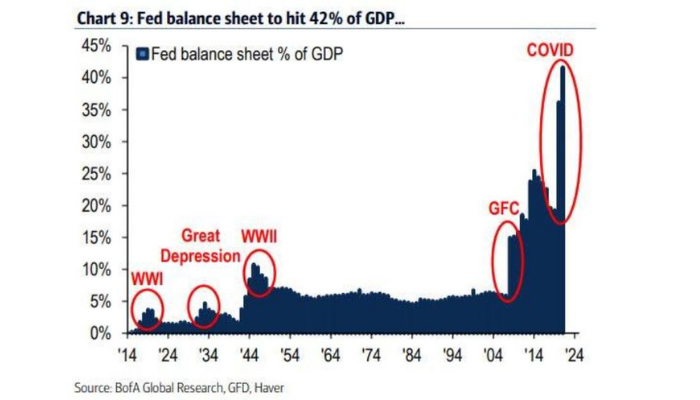

Scenario 2 is that the vaccines don’t curb the virus quickly, that corporate earnings disappoint as a result, and that governments take even more radical steps to create (borrow) and spend relief funds. The Fed and the other central banks are already on track to put much more debt on their balance sheets (as a way of quarantining that debt from market forces), but it’s not clear how much longer that will work given the nosebleed levels of debt already:

Sensible, orderly, and solid

One thing seems certain about how 2021 will play out: with continued uncertainty across markets, politics, and the economy. We think investors and savers seeking to find some order amongst the chaos will choose gold again in 2021, certain in the knowledge they are building durable wealth that has stood the test of time.