Many people have helped shape our product as we have grown. Few people have had a greater single impact early in our journey than Bernard Lietaer, who sadly passed away yesterday at the age of 77.

Bernard was arguably the world’s foremost monetary scientist.

When bestowing that accolade of course we are passing by much better-known academics and economists whose work touches the fundamentals of how money works, including the likes of major figures like Paul Krugman and Ben Bernanke. But unlike most people considered titans in the field today, Bernard dedicated his life and career to diligently understanding the actual fundamentals of how man has interacted with money throughout history, not just to replaying and reworking the ruling (and failing) neo-Keynsian orthodoxy of the world’s monetary thinkers and central bankers.

As an academic at M.I.T., later at the Central Bank of Belgium (where he was the architect of the predecessor of the Euro, the ECU), and then as a Distinguished Fellow at Berkeley, Bernard pioneered the field of alternative or “complementary” currencies. Money, he felt, should serve mankind, and not the other way around. He applied disciplines that used actual evidence and the abundant historical record to debunk the current orthodoxy and show the way forward to new forms of money that are sustainable, do not concentrate wealth ever upwards, and do not rely on the ongoing creation of ever-larger mountains of debt.

We hired Bernard in the early days of our company as a consultant to help us understand what money should be and could be.

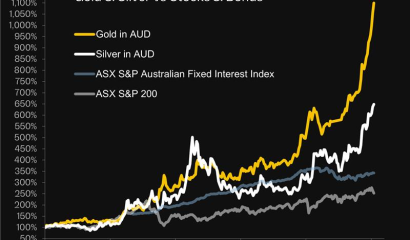

At the time there was a rising buzz about cryptocurrency, and indeed Bernard ended his career as Chairman of the major crypto firm Bancor. But at the end of his assignment with us Bernard’s all-up advice was short and sweet: “just solve gold”. With his commanding view of the great sweep of monetary history, where debt-based national currencies have a failure rate of 100% and an average lifespan of just 43 years, of course Bernard understood the immense and enduring value of that shiny and rare store of value that has successfully withstood every economic and political test for more than 6000 years.

We’re quite proud to say while we have many improvements still in the works we have substantially “solved” gold per Bernard’s advice. With SendGold it’s a store of value and a medium of exchange, two of the major tests for the definition of “sound money”, and we think Bernard would be proud. His immense knowledge, courageous scientific curiosity and shy professor’s grin will be sorely missed by everyone here on the SendGold team.