Whether to protect against a market downturn or to keep up with inflation, it’s proving popular to keep savings in gold.

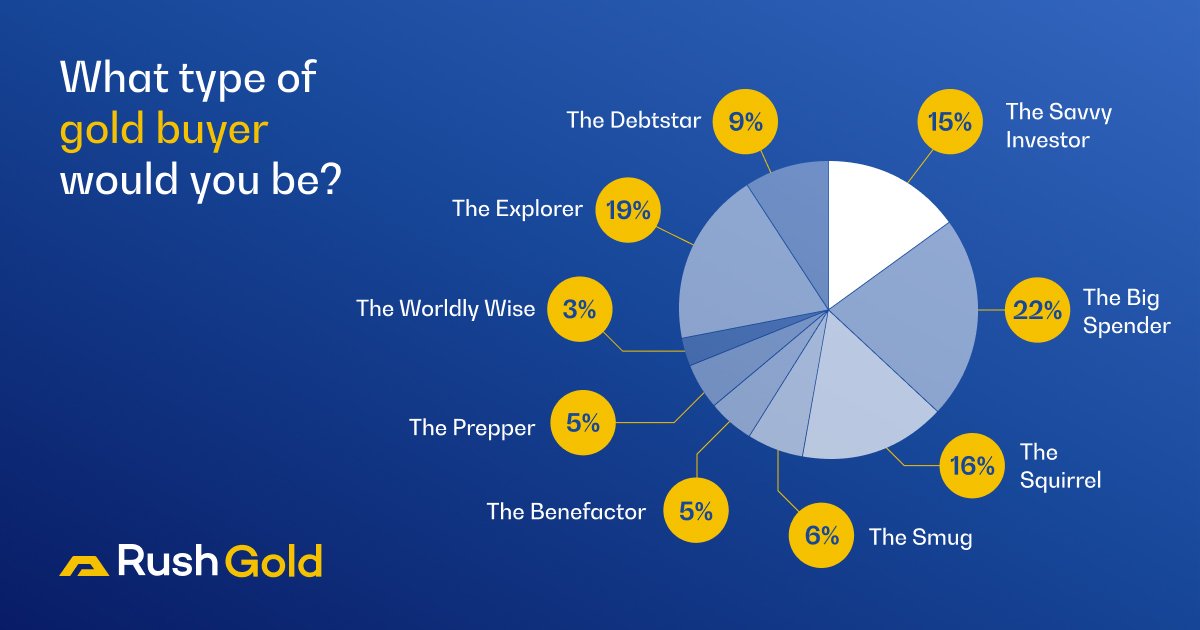

In fact, 44% of our Rush Gold customers said they were using Rush Gold to save. Here’s the breakdown:

22% of Rush Gold users are placing their savings in gold in preparation for a big investment. Be it a new car, a cruise trip, or college for the kids, a large purchase is a classic reason why people save—so it’s no wonder our users are relying on gold to hold on to the value of their savings.

16% of users are boosting their retirement savings by putting their trust in gold. Diversifying your assets makes great financial sense, and with gold generally running counter-cyclical to stock cycles, as well as protecting against inflation, many of our customers are finding gold a valuable insurance policy as they plan for their future.

6% of Rush Gold account holders are trying to get out of debt as soon as possible by paying off their home loans. For them, protecting their savings to pay off debt is a valuable and future-focused method of ensuring an inflow of wealth into their savings once their outflow has stabilised.

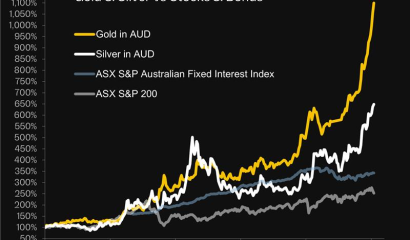

Unlike most other investment options, the value of gold also increases when the cost of living goes up. This means that when currency dips and inflation rates climb higher, gold can help you hold on to your savings, and even increase them.

The bottom line

Gold is more than a commodity that crosses cultures, countries, and crises and comes out on top.

It’s a global currency and store of vague, and it’s the perfect way to balance your investments.

With Rush Gold, you have the combined benefits of the safety of an Australian vault, and the convenience of a payment app!

Your hard-earned savings should be yours to protect, and here at Rush Gold, we help you keep your wealth in your hands.

If you want to protect your savings, now may be the time to rush to gold.