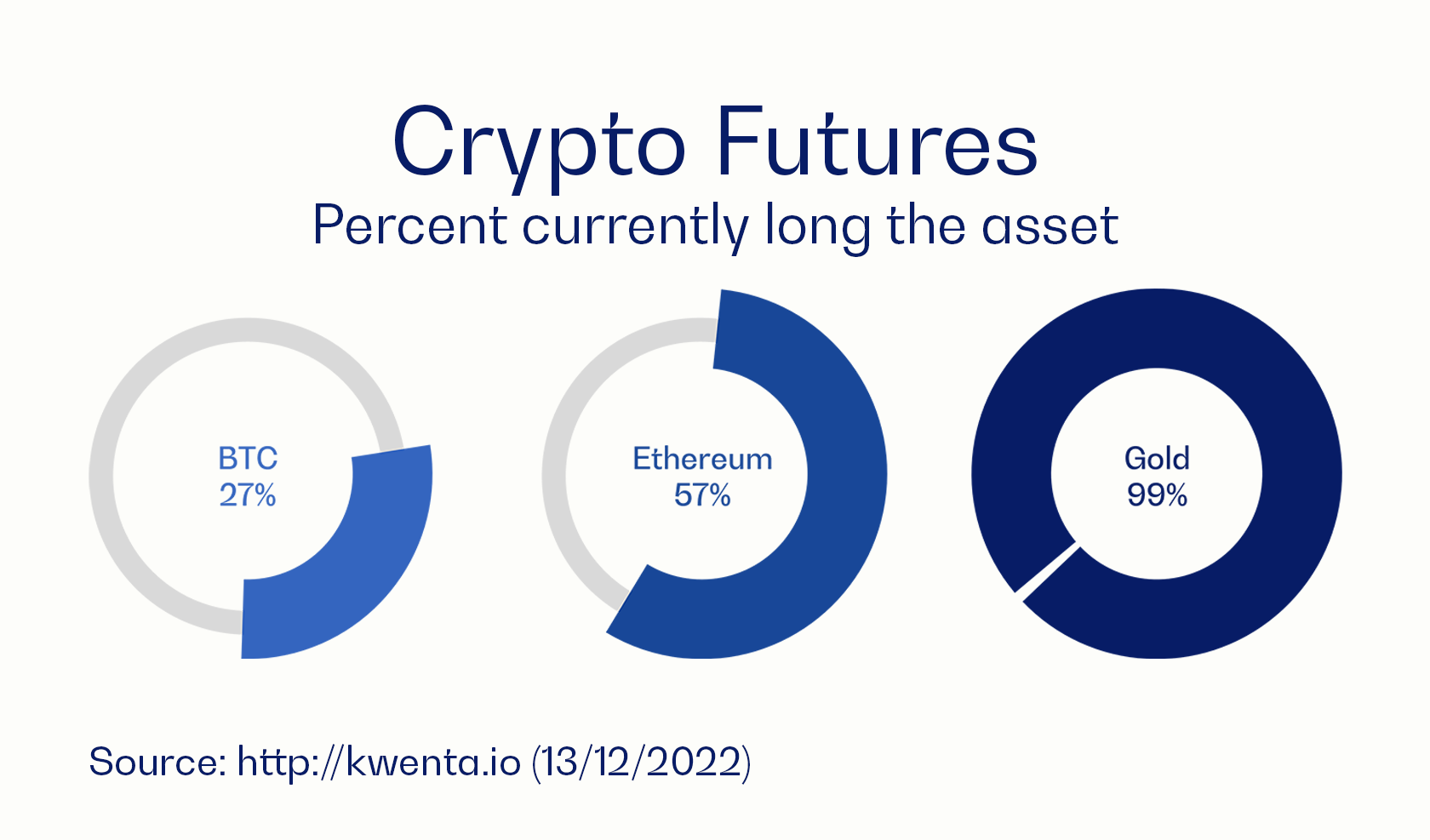

Among blockchain futures traders on the Kwenta platform, gold is viewed as being the asset most likely to rise in the short to medium term. These traders are currently 28% long on BTC, 57% long on Ethereum and 99% long on gold.

Analysis of investor sentiment on the platform, which is a recently launched Ethereum Layer 2 perpetual futures exchange, shows an overwhelmingly long bias for the yellow metal vs BTC and Ethereum.

Kwenta is built on the Synthetix platform, which was founded here in Australia.

Perpetual futures on this exchange allow people to place up to 25x leveraged bids on these assets. The higher the leverage, the smaller the buffer between the current price and the price at which the investor is liquidated, should the price fail.

This data is significant as its users could be classified as primarily crypto natives, investors, advanced traders and developers.If sentiment in this advanced trading community is more bullish on gold than they are on crypto, this is a sign of rising sentiment towards this stable inflation resistant asset.

Source – http://kwenta.io (13/12/2022)