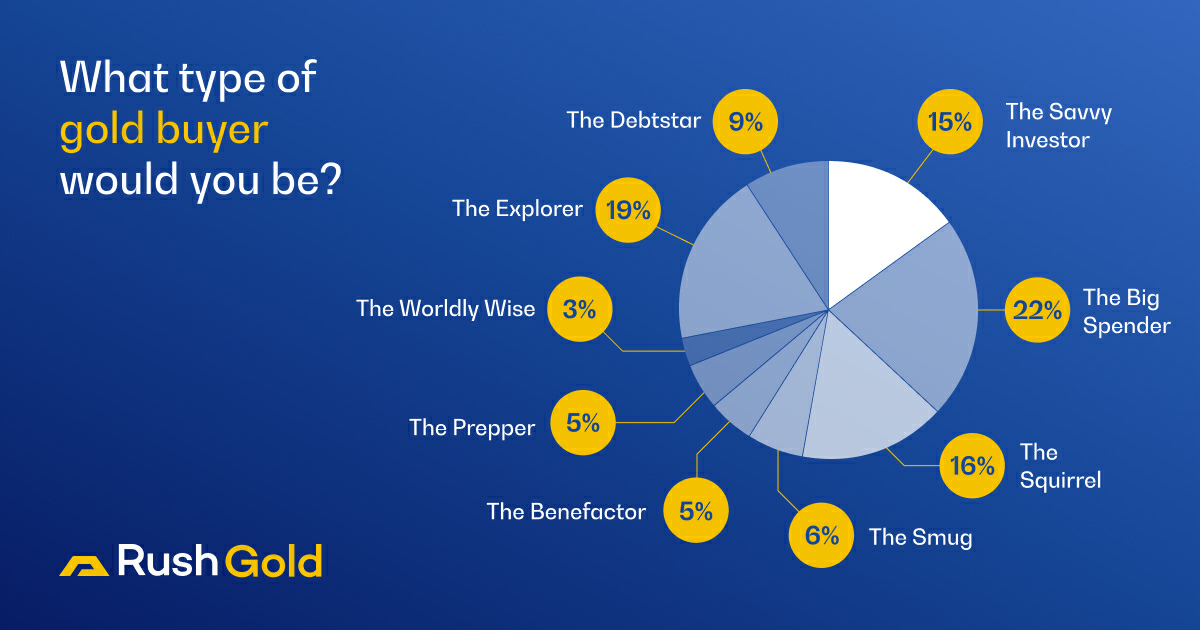

Is using gold for portfolio diversification something you have chosen to do? If you have, then you’re joining 15% of Rush Gold users who we call Savvy Investors because they know what’s what in the investment market.

You can take a look at why the nine different Rush Gold users we’ve identified choose to buy gold in our blog post: What type of gold buyer are you?

Portfolio diversification isn’t just about spreading your investments thin, it’s about ensuring that you don’t put all your eggs in one basket and are mitigating the risks that inevitably come with every investment you make.

Investing your wealth in one industry or asset—in other words, putting all your eggs in one basket—is never advisable. No matter how much or how little you invest or how secure your investment may seem.

There are obvious downsides to putting your eggs in different baskets. For example, when one item in your portfolio starts performing poorly it can drive down the value of your entire portfolio. Conversely, when one item in your portfolio starts performing well it can feel like a loss that you didn’t invest more in that option.

Although it can be tempting to put your money into one, high-performing investment option, it’s important to keep in mind that even the market trends that seem like losses, are just short-term effects.

In the long term, more diversified portfolios tend to bring in higher returns and perform much better than their less-diversified counterparts.

Why choose gold for portfolio diversification?

As an investor, no one is infallible. The market is impacted by a huge number of interlocked factors that affect its performance at any one time.

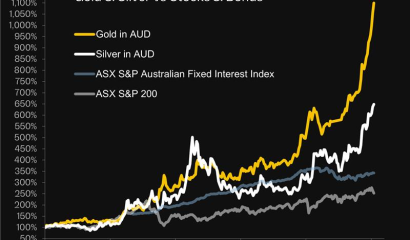

Add to that the crises and unprecedented events that can completely transform a market overnight, and the value of using gold for portfolio diversification becomes clear.

It’s already clear to 15% of Rush Gold users.

Physical gold is more than just its shiny exterior. Over the years, as gold derivatives have started to emerge, gold has managed to retain its title as one of the most secure investments that ETFs just can’t meet.

It achieves this by providing something that few investments can—systemic risk protection.

Most investments need the system that supports them to function well in order to yield returns. This means that when the system supporting the investment fails, so does the investment. These failures occur quite frequently and can be spurred on by recessions or governmental changes.

With physical gold ownership, there is no middle man or system. When you own physical gold through Rush Gold, you are the direct owner of gold bullion and your rights are protected by property rights laws.

This is the secret to why gold has managed to retain its throne for centuries and continues to be a great way to maintain generational wealth and keep your money in your hands.

It’s also why our Savvy Investors have chosen this precious metal as a stable investment that is sure to yield returns in both the short and long term.

Skilfully manage your portfolio

As your investment portfolio blossoms, it may also become harder to manage. This is another con to diversification that we aim to mitigate with your gold investment portfolio.

Yet another challenge is keeping your eye on the many different markets you’ve made investments in so you know when to make your moves and expand your portfolio.

Our award-winning platform brings gold to the modern age by giving you all the tools and information you need to manage your gold investment portfolio on your Rush Gold account. We consolidate everything, from price alert features to features that allow you to gift gold internationally, into one easy-to-use interface.

If it seems like 15% of our users have the right idea, it may be time to start diversifying.