Warning: Undefined global variable $buildercount in /home4/sqzstage/public_html/rush/wp-content/themes/rush/functions.php on line 155

Now that the economic fallout of Covid-19 is becoming a little clearer, we can discuss the possible effects on investing and on gold price in particular.

Each of the factors discussed below (and in Part 1) – gold’s performance during the last crisis, the further selloff of lower-quality assets, the potential for another sovereign debt crisis, and the potential for higher inflation when stimulus payments arrive – all argue in our view for a steady and continued rise in the price of gold.

Gold was already a top-performing investment

Prior to the crisis (and prior to the recent run-up in the price of gold) Price Waterhouse Coopers prepared a report for the world’s largest investors – the so-called “sovereign wealth funds” from countries like Singapore and Norway.

In that report, they pointed out that gold had already outperformed the top two major asset classes (shares and bonds) over the previous 10-year and 20-year time periods: https://www.pwc.com/gx/en/industries/sovereign-wealth-investment-funds/publications/alternative-assets-for-sovereign-wealth-funds.html

Gold tops the charts so far in 2020

So going into the Covid-19 scare, gold was already one of the world’s top-performing investment asset classes.

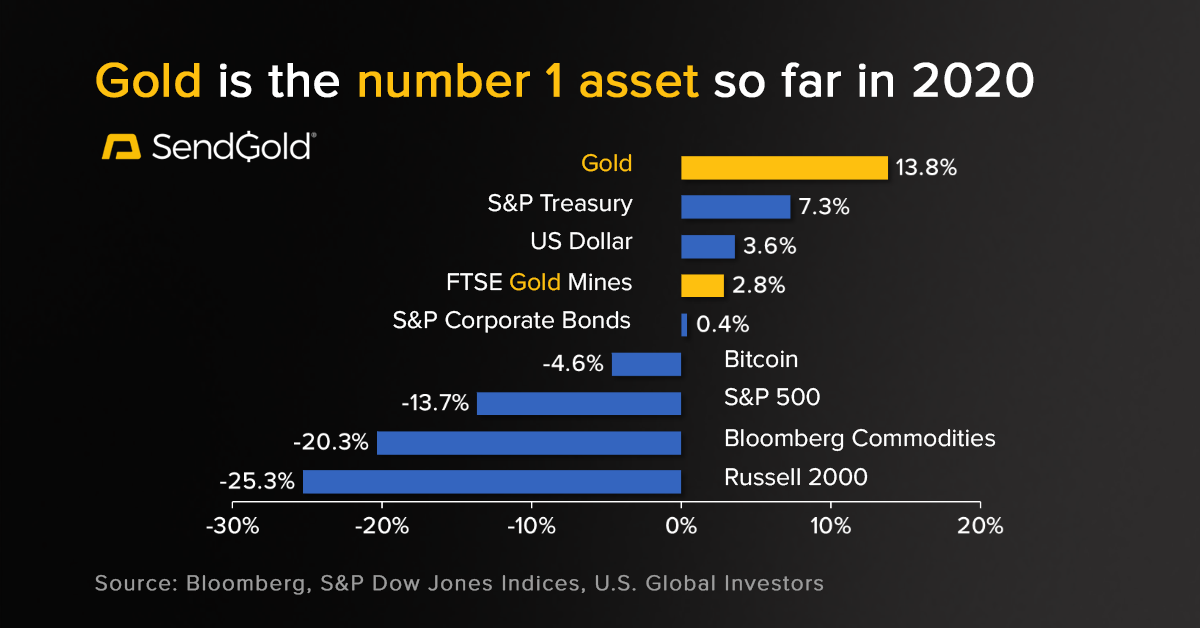

And so far this year gold has added even more to that winning form, outperforming everything from shares to bonds to commodities to Bitcoin. The chart above shows the year-to-date returns for 2020 (through 10 April). We believe there is a high likelihood for that outperformance to continue, for a number of reasons.

Covid-19 means governments must print the money people need

Most governments are putting through very large stimulus packages. In the U.S. the stimulus already exceeds USD $2 trillion.

But J.P.Morgan’s chief economist Michael Feroli noted, “In response to the Covid-19 crisis, the U. S. Federal Reserve Bank has effectively shifted from lender of last resort for banks, to a commercial banker of last resort for the broader economy.”

This change means there is a heightened risk of a “sovereign debt crisis”, where the government itself cannot pay its bills and has to default.

It’s worth recalling that sovereign debt crises only resolve in one of two ways: either government bond investors take big losses (or get wiped out altogether) or inflation or hyper-inflation debases the currency (makes it less valuable) to the point where the size of the remaining debt is manageable.

And the lesson of the last major country sovereign debt crisis is worth noting: the world’s six biggest economies’ currencies lost between 75-95% of their value against gold over the course of less than a decade.

And what happens when the stimulus payments start arriving?

If we look ahead a few weeks or months to a time when the financial market selloffs have abated somewhat and stimulus payments begin arriving, Deutsche Bank recently made an interesting argument. They believe that this will be inflationary, and possibly even hyper-inflationary:

“This is because policymakers appear to be attempting to shift demand back to where it was a couple of months ago, at the same time as holding supply fixed. To put it another way, if the government tries to keep spending at levels before lockdowns began, while at the same time keeping lockdowns in place, there will be simply more money chasing after significantly fewer goods and services. The result of this will be inflation, and a lot of it.”

A return of inflation would be a large positive for the price of gold.

Gold price target: USD $3000?

Today Bank of America wrote in a research note to their clients, “As the ultimate store of value, gold is a reflection of market movements across all major financial and physical assets… and the gold market has further room to run, in our view.”

The Bank of America research note continues: “Now, with the Fed committing to do whatever it takes to prevent widespread bankruptcies across the US, Congress injecting a USD $2 trillion fiscal stimulus plan, and economic growth on standstill until there is a cure or a vaccine, inflation could rise even if GDP does not. This backdrop should prove very positive for gold”.

“We have been long-term gold bulls, maintaining our constructive forecast even through the recent volatility. Hence, we are marking-to-market expectations, while at the same time anticipating further upside. Thus, we increase our 18-month gold target price from USD $2,000 to USD $3,000/oz.”

At today’s exchange rate that would mean a gold price of AUD $4,761 per ounce, up from today’s price of approximately AUD $2,700 per ounce.

Conclusion

So we reiterate our opinion from our 2020 Gold Outlook: Accumulate. SendGold makes it easy.

SendGold Update – Ramping up Services as Gold Demand Skyrockets

Gold and the Ongoing Covid-19 Crisis, March 24 Update – Part 1 of 2

Download our new app now and BUY 100% title to GOLD in minutes