Gold Market Update

After a 24-month trend where gold prices climbed steadily higher the market had a large selloff related to euphoria around a possible Covid vaccine. The selloff corrected what technical analysts call an “overbought” situation.

While headlines last Friday said “Gold has its best week since July”, headlines today show “Gold slumps 4% on Covid vaccine hopes”. The potential for an effective Pfizer vaccine encouraged investors to increase their exposure to stocks.

“If you think that you’re living in the best of all worlds, then you may feel you do not need as much gold,” said Commerzbank analyst Daniel Briesemann.

“However, this assessment seems to be premature. And we’ve often seen in the past that at prices below $1,900, buying interest will come into the market – we would expect that to happen again this time.”

In the West lower prices tend to see investors pause buying or selling gold, while in the East investors take advantage of lower prices to buy larger amounts.

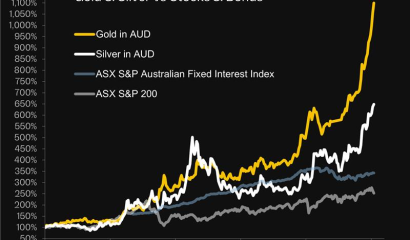

Gold price this month in AUD/OZ

Looking for a way into gold? Gold prices are down this week. Now is the time. Click through for offer details.

SendGold Viewpoints

In this week’s blog, we discuss some of the market and economic certainties around the U.S. election and how investors can keep their eyes on the bigger picture no matter who is certified as U.S. president. Read the article.

Gold in the News

Here are a few articles trending on the subject of gold.

SendGold CEO Jodi Stanton explores how Australia can combine two of our key national resources, technology expertise and gold mining. “By marrying these two national strengths, we could be setting up Australia to become a global economic powerhouse for many years to come, as investors seek financial strength and certainty instead of ever-mounting piles of debt”. Read the article.

SendGold co-founder Mark Pey was interviewed on ausbiz for his views on elections and how they might impact gold prices. Watch the video (free login required).

Saxo Bank’s Ole Hanson, Head of Commodity Strategy, calls today’s gold price sell-off “a weak correction within a bull market”. Read the article.

SendGold was just named ‘Best Investment Innovation’ 2020 by Finder Awards. Read the article.

SendGold Handy Hints

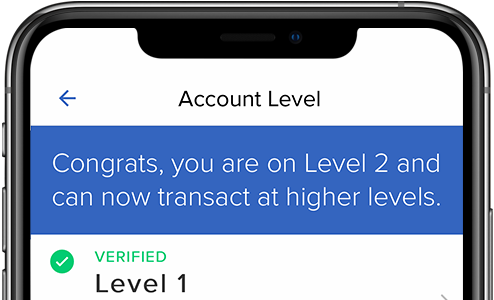

Our Level 2 accounts have had a tremendous response!

If you have a Level 1 account and wish to transact more than A$5,000 (~US$3,600) at a time, upgrade to a Level 2 account and you’ll be able to transact up to A$100,000 (~US$ 72,000) at a time, with larger weekly transaction limits and account balances.

Look for the ‘Account Level’ in the menu on the SendGold app.

Remember, we are here to answer any questions. Just email us on customerteam@rush.sqzstage.com.