Warning: Undefined global variable $buildercount in /home4/sqzstage/public_html/rush/wp-content/themes/rush/functions.php on line 155

This week both J.P. Morgan and Bank of America advised their biggest clients to buy gold to protect their wealth in worsening economic conditions.

J.P. Morgan’s Private Clients

This week J.P. Morgan’s Private Client division released a recommendation to buy gold to their biggest institutional clients. Their recommendation echoes what we at SendGold have been discussing since our inception:

J.P. Morgan holds USD $2.089 trillion in assets for these customers and they recommended they should now invest 5% of their portfolios into gold:

Bank of America Investment Recommendation

Echoing J.P. Morgan, today Bank of America issued a research note to its largest investment clients. In it they stated the unthinkable: that the extraordinary central bank actions we’ve seen since 2008 (so-called “quantitative easing”), might fail altogether:

“The risk of quantitative failure, which was not a concern in 2008, makes gold an attractive asset.”

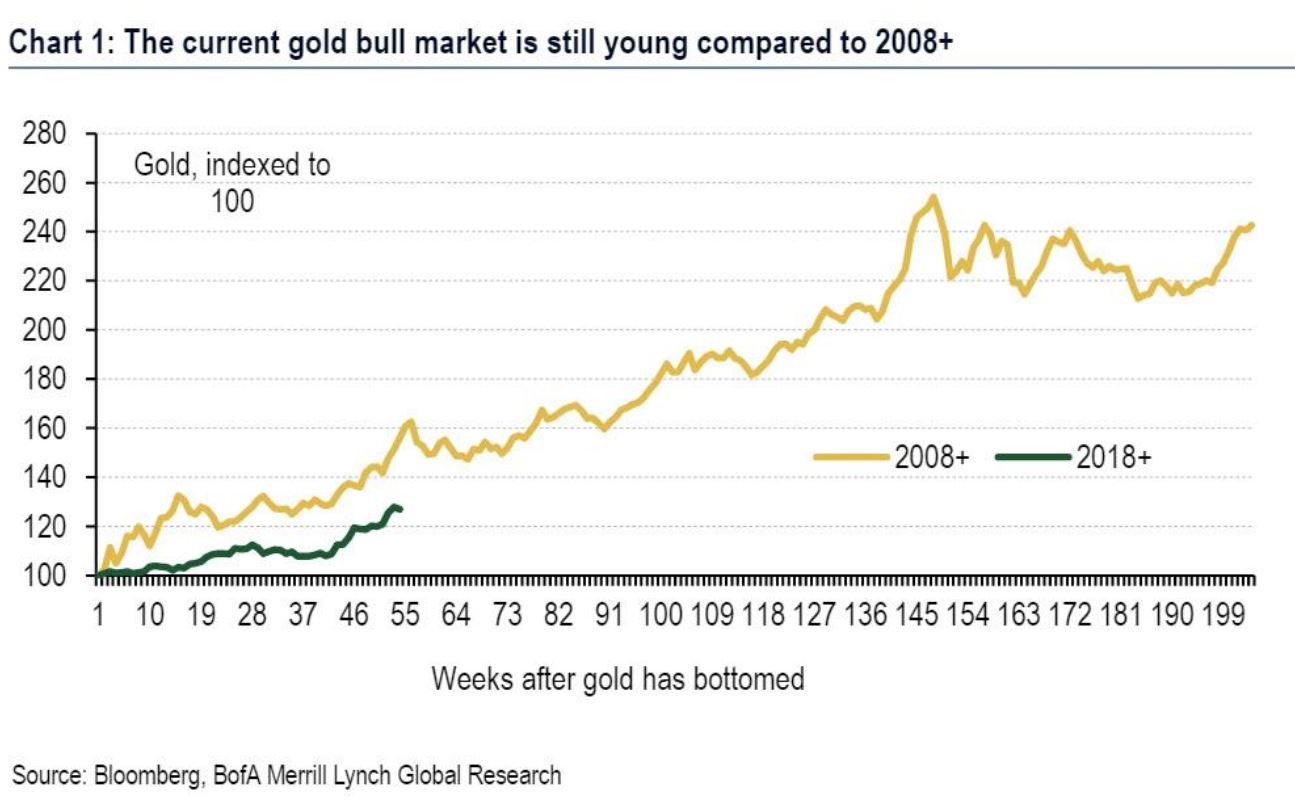

The B of A report includes the following chart comparing the gold bull market following 2008 with conditions today. The implication is that the current gold price rally still has a long way to run:

In our long experience in markets, investment recommendations are only rarely this definitive. But more importantly, the fundamental reason to own gold – as an independent hedge against financial market uncertainty – is now stronger than ever.