PwC released it’s latest report, The rising attractiveness of alternative asset classes for Sovereign Wealth Funds.

“In addition to being a hedge against crises, gold outperformed all traditional asset classes on a ten- and twenty-year basis.”

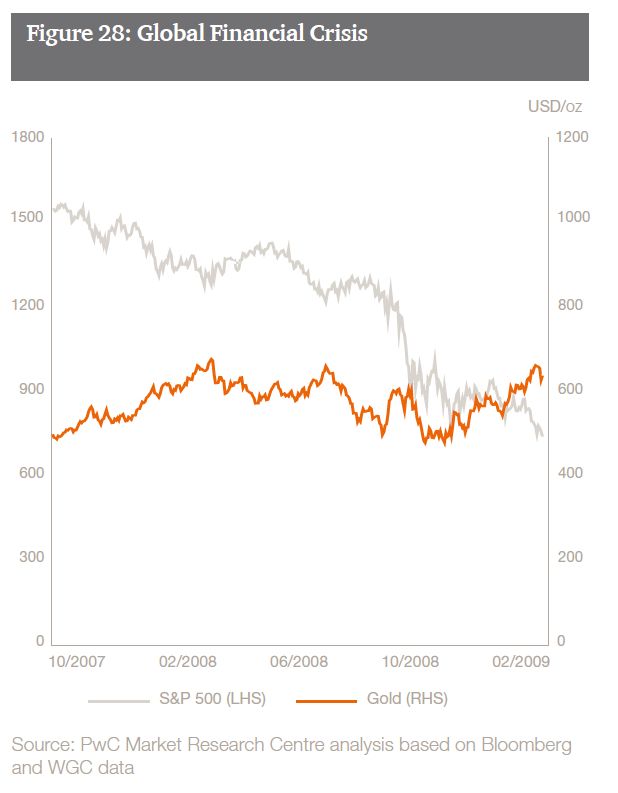

“Among alternatives, when examining the correlation returns with the S&P 500 index, gold is an excellent diversifier.”

“Gold as an asset class can offer reliable support, not only during uncertain market and political conditions, such as periods of high inflation, stock market crashes, and geopolitical instability, but also under normal market conditions. The investment case for gold, during periods of market uncertainty, has proven to be strong, with the price of gold having surged rapidly and having countered the negative effects of adverse market conditions. Hence, investors can consider gold for diversification and long-term performance.”

Link here to read the full report:

https://www.pwc.lu/en/alternative-investments/docs/pwc-sovereign-wealth-funds.pdf

SendGold’s equity crowdfunding offer is currently open via the OnMarket platform. SendGold is targeting a minimum raise size of $500,000, and a maximum of $2 million. The minimum bid size into the offer is $250. Invest now at OnMarket to own a piece of this company that has turned gold into accessible, peer to peer, digital money.

CLOSES FRIDAY 14 SEPTEMBER!

Consider the offer document and general risk warning before applying.