Warning: Undefined global variable $buildercount in /home4/sqzstage/public_html/rush/wp-content/themes/rush/functions.php on line 155

A comment by Warren Buffet may hold a key to reaching your financial goals

Legendary investor Warren Buffet once noted that “in the short run the market is a voting machine, in the long run it’s a weighing machine”.

Sometimes building a wealth strategy means that you must think beyond what the financial press is telling you. The main goal of that press is to get ad revenues from daily (or even hourly) clicks, which means they tend to give extra importance to short term price movements. This gives them something to report on.

But unless you are a short-term trader, paying too much attention to this hourly, daily, or even monthly noise can be a distraction. Even worse, focusing on short term price gyrations can manipulate your emotions, which can potentially lead to poor (and expensive) investment decisions.

Buffet’s comment was reported in Forbes magazine, which went on to break it down. Short term market movements, Forbes explained, “reflect all kinds of irrational attitudes and expectations, whereas in the long run the market will weigh and reflect an investment’s true value”.

And the late John Bogle, the former CEO of Vanguard funds and the founding father of index investing, made a similar point. “Succumbing to the wiles of Mr. Market”, Bogle wrote, “allows the emotions of the moment to take precedence over the economics of the long term, as transitory shifts in prices get investors thinking about the wrong things”.

Using Buffet’s insight to your advantage

This insight can serve as a guide to an investment strategy designed to build real wealth over the medium and longer term.

You would start by taking a view on which investment assets you want to accumulate. These could be shares of certain top-quality companies, real estate, valuable precious metals, or other investment assets.

The next step would be to ask a simple question: at what price do you wish to invest in these assets? This is where separating yourself from the short-term herd can feel unsettling. Why would you buy more of an investment asset whose price has gone down?

Applying the same buying instincts you use for everything else (buying more when things go on sale) to your chosen investment assets may be the way to go.

Asian gold buying may be an example of Buffet’s advice

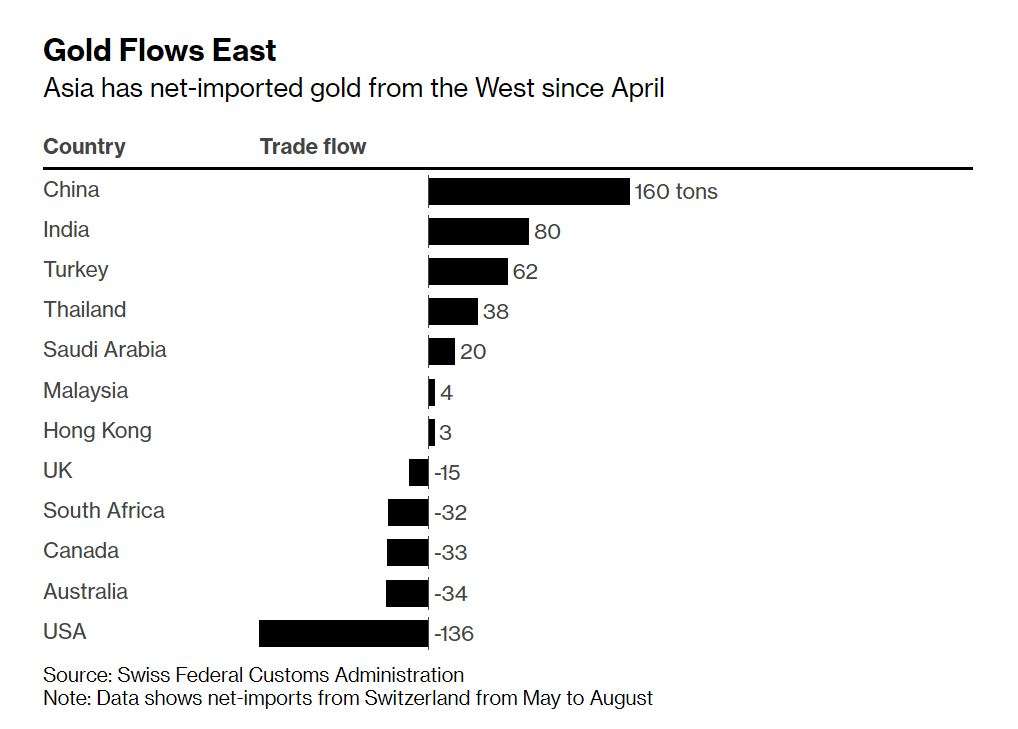

One example of this kind of buying behaviour is gold buyers in Asia. As the chart below shows, Western gold buyers have been selling as gold prices have declined (as they have in U.S. Dollar terms so far in 2022) Asian buyers, by contrast, have been doing the opposite. China, India, Turkey, Thailand, and Malaysia are using the opportunity of softer gold prices to accumulate even more gold:

This may be in part because Asian buyers have experienced severe currency crises in the recent past.

In the Asian Financial Crisis, for example, investors across Asia lost 50% in the space of one week just by holding their national currencies. This has given them a heightened appreciation for gold, history’s most reliable form of money.

But investors everywhere may want to take heed. The currency crisis we are currently experiencing is not confining itself to emerging markets in Asia or to secondary countries.

By contrast, the current currency crisis is enveloping the major currencies like the pound, the euro, and the yen. The mighty Japanese yen, for example, has already depreciated against gold by 22% in the last year. Gold in pounds recently hit a new all-time high.

And the Australian dollar, despite our strong resources and energy income, has not been immune from the currency crisis. It has already fallen from $1.05 per U.S. Dollar ten years ago to $0.62 per U.S. Dollar today. Following Buffet’s investment advice – to think less about price and more about value – could lead to better outcomes, no matter what assets you are investing in.

Download our app now and BUY 100% title to GOLD in minutes