Sydney, Australia (December 2020):

When even the investment banks sound the alarm about share prices it may be wise to listen

Investment banks have a reputation for issuing “Buy” recommendations on shares much more frequently than “Sell” ratings.

In the Dot Com era from 1997-2002 just 1% of bank ratings were “Sells”. That period ended with NASDAQ shares losing more than 70% of their value. Since that time, following Congressional hearings, just 5% of ratings have been “Sells”.

https://finance.yahoo.com/news/why-wall-street-analysts-almost-142405077.html

So some of the recent headlines from the major investment banks about share prices caught our eye:

“Code Red Alert For Stocks” – Bank of America, December 4

“We are in the 98th Percentile” – Goldman Sachs, December 7

“The State of Markets is Farcical” – Rabobank, December 8

In our view, there are two main problems with share investing today at all-time highs and earnings multiples: what companies are doing and what people are doing.

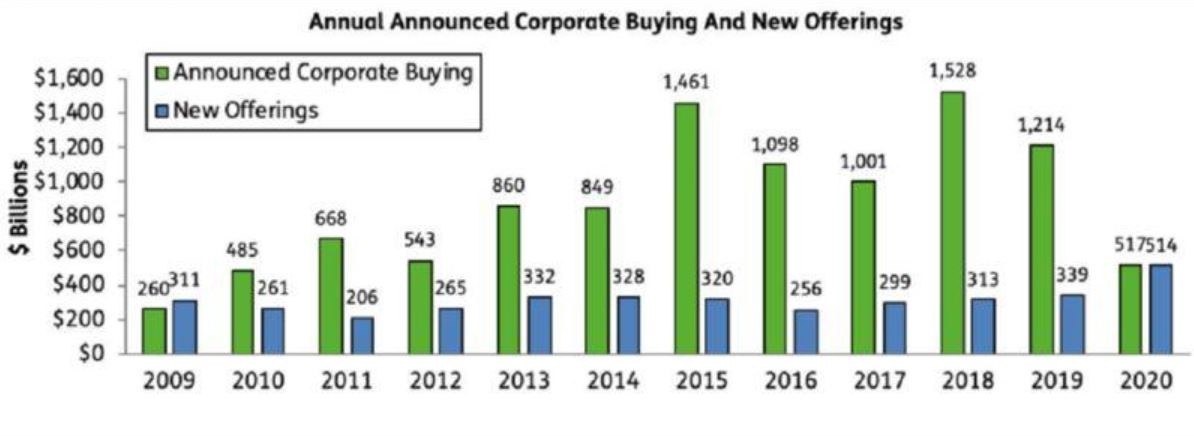

After ten years of buying back their shares (so with fewer shares available the price per share goes up), companies are now selling as many of their shares as they are buying:

And on the people side, with 70% of economic activity from consumer spending, it’s important to keep an eye on how consumers are faring. A recent survey showed that 63% of people have cut back on spending during Covid-19.

And a distressing 82% of Americans said they would now have to borrow the funds for a $500 emergency. You can learn more here.

Share investing can be a key part of a balanced investing approach, especially when shares can be accumulated at reasonable prices.

But banks rarely tell you to sell. Today they are. Take heed.