Seasoned gold buyers know that from time to time there are pauses as gold reprices against the ever-rising quantity of bank currencies.

We experience these pauses as short-term price declines inside of a rising trend. Put differently, this means that gold temporarily goes on sale.

In the gold bull market of the 1970s—when gold prices multiplied by ten—we saw a decline of 50% along the way. From $200/oz to touch $100/oz. Savvy buyers who accumulated gold during that pause were rewarded for their patience:

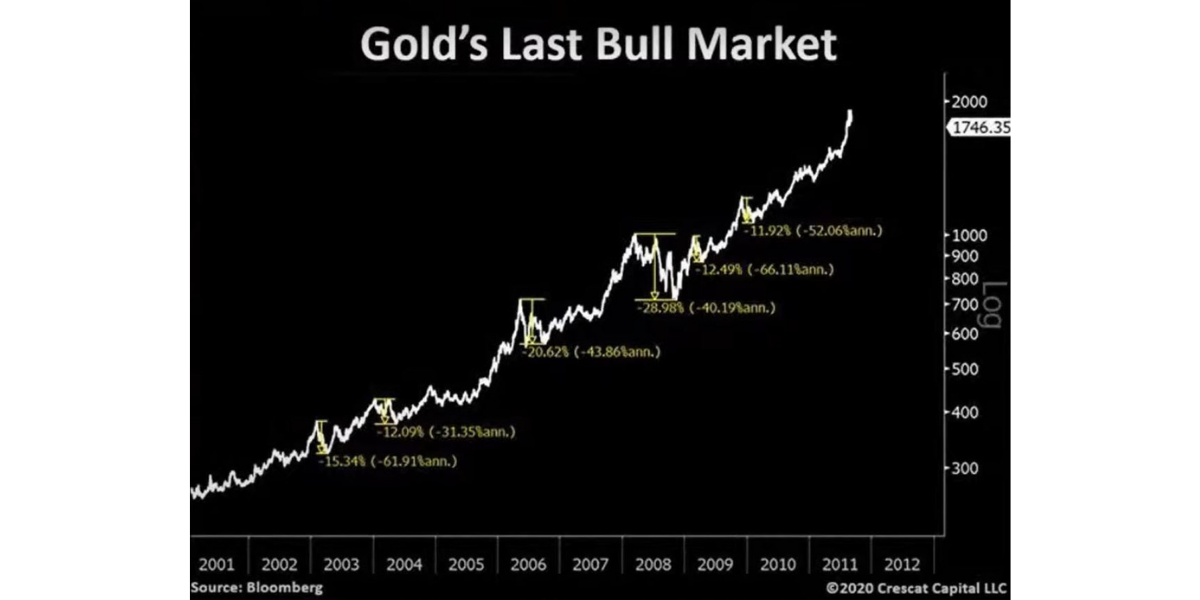

Similarly, the gold bull market run that started in 2001 had numerous price declines along the way. The largest of which was around 29%:

(For perspective, the pause that started around last August in the current run is about 20%, depending on your currency.)

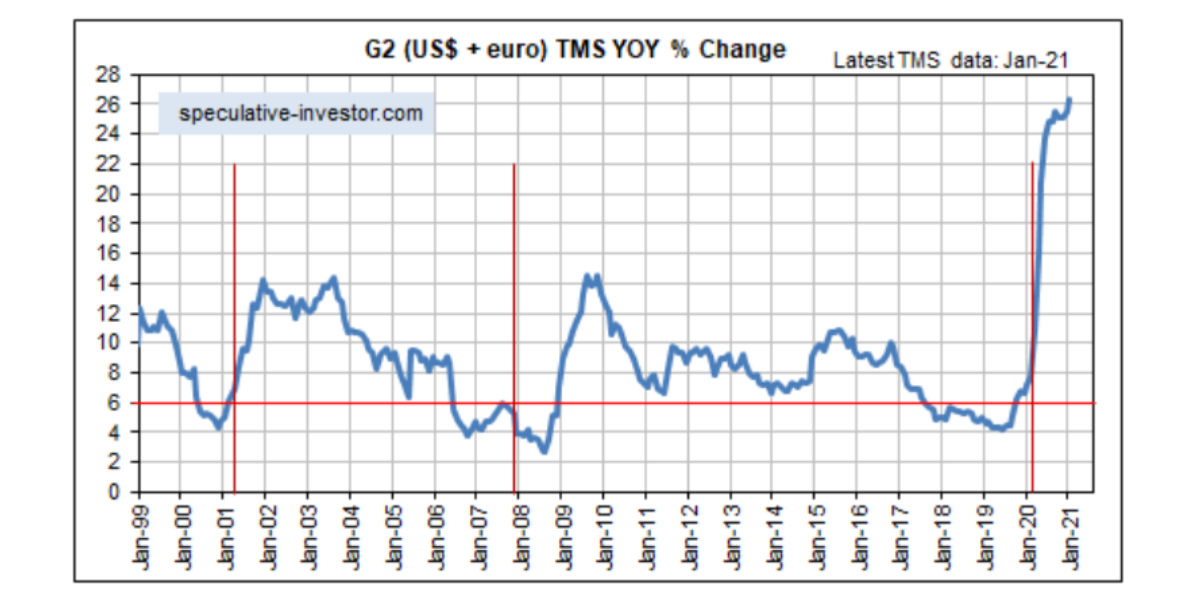

If we take a step back, it’s worth noting here that the current spike in the number of bank currencies being printed around the world is one for the history books. From a long-term average annual increase of around 8% per year, we have shot up to a 26% increase:

The chart above does not reflect the additional USD $2-4 trillion in new (borrowing and) spending that is planned by the current US administration.

To translate: a very fast-rising quantity of money will soon be chasing a slow-rising quantity of goods and services. As a reminder of what this looks like in the real world, here is a graphic showing the steady rise of the price of a cup of coffee:

We’ve already experienced steady inflation in shares, bonds, and real estate, so these may provide very limited upside protection against inflation going forward. Few analysts are describing those assets today as “bargains”.

By contrast, if history is to be our guide, previous inflation episodes tell us that gold may be at the head of the list of assets that are currently in the “bargain” category. It’s your move—and with Rush Gold, it’s easier than ever to make it.